Entrepreneurship is NOT Risk-bearing

Most of the literature I read in economics, management, and entrepreneurship remains sloppy in distinguishing between risk and uncertainty. As we approach the centennial of the publication of Frank H. Knight’s Risk, Uncertainty, and Profit, it is time to revisit his essential thesis: (1) static, deterministic economic models of the firm provide no causal explanation for the existence of profit; (2) where risk can be characterized by a priori or statistical probability distributions, this reduces to the deterministic account and profits will not exist; and (3) profits arise from uncertainty, which is a knowledge problem that can be inherent in the external state of nature or in the boundedness of the economic agent.

Here is the essence of Knight’s argument for uncertainty-bearing as entrepreneurship:

“At the bottom of the uncertainty problem in economics is the forward-looking character of the economic process itself. Goods are produced to satisfy wants; the production of goods requires time, and two elements of uncertainty are introduced, corresponding to two different kinds of foresight which must be exercised. First, the end of productive operations must be estimated from the beginning. It is notoriously impossible to tell accurately when entering upon productive activity what will be its results in physical terms, what (a) quantities and (b) qualities of goods will result from the expenditure of given resources. Second, the wants which the goods are to satisfy are also, of course, in the future to the same extent, and their prediction involves uncertainty in the same way. The producer, then, must estimate (1) the future demand which he is striving to satisfy and (2) the future results of his operations in attempting to satisfy that demand.” (Knight, 1921, section III.VIII.8).

Interestingly, Carl Menger says much the same thing in his 1871 Grundsätze der Volkswirtschaftslehre (Principles of Economics), half a century prior to Knight.

“[t]he greater or less degree of certainty in predicting the quality and quantity of a product that men will have at their disposal due to their possession of the goods of higher order required for its production, depends upon the greater or less degree of completeness of their knowledge of the elements of the causal process of production, and upon the greater or less degree of control they can exercise over these elements. The degree of uncertainty in predicting both the quantity and quality of a product is determined by opposite relationships. Human uncertainty about the quantity and quality of the product (corresponding goods of first order) of the whole causal process is greater the larger the number of elements involved in any way in the production of consumption goods which we either do not understand or over which, even understanding them, we have no control—that is, the larger the number of elements that do not have goods-character.” (Menger, 1871, Ch.1, Sec. 4, Zeit—Irrthum [Time and Error]; translated by Dingwall and Hoselitz, 2007)

Menger also has a passage that explicitly dismisses risk.

“… it will be evident that I cannot agree with Mangoldt, who designates “risk bearing” as the essential function of entrepreneurship in a production process, since this “risk” is only incidental and the chance of loss is counterbalanced by the chance of profit.” (Menger trans 2007, p. 161).

Menger footnotes this disagreement based upon Mangoldt (1855). In the original, one finds “die “Gefahr”doch nur etwas accidentielles ist” (Menger 1871, footnote to page 138). The risk is accidental, not incidental. Thus, it appears that Menger denies risk-bearing, in the sense of aleatory probabilities of economic outcomes, as an entrepreneurial function.

More on this in coming posts.

La máquina del mundo es harto compleja para la simplicidad de los hombres.

Inferno I, 32 Jorge Luis Borges, El Hacedor, 1960

Desde el crepúsculo del día hasta el crepúsculo de la noche, un leopardo, en los años finales del siglo XII, veía unas tablas de madera, unos barrotes verticales de hierro, hombres y mujeres cambiantes, un paredón y tal vez una canaleta de piedra con hojas secas. No sabía, no podía saber, que anhelaba amor y crueldad y el caliente placer de despedazar y el viento con olor a venado, pero algo en él se ahogaba y se rebelaba y Dios le habló en un sueño: “Vives y morirás en esta prisión, para que un hombre que yo sé te mire un número determinado de veces y no te olvide y ponga tu figura y tu símbolo en un poema, que tiene su preciso lugar en la trama del universo. Padeces cautiverio, pero habrás dado una palabra al poema”. Dios, en el sueño, iluminó la rudeza del animal y éste comprendió las razones y aceptó ese destino, pero sólo hubo en él, cuando despertó, una oscura resignación, una valerosa ignorancia, porque la máquina del mundo es harto compleja para la simplicidad de una fiera.

Años después, Dante se moría en Ravena tan injustificado y tan solo como cualquier otro hombre. En un sueño, Dios le declaró el secreto propósito de su vida y de su labor; Dante, maravillado, supo al fin quién era y qué era y bendijo sus amarguras. La tradición refiere que al despertar, sintió que había recibido y perdido una cosa infinita, algo que no podría recuperar, ni vislumbrar siguiera, porque la máquina del mundo es harto compleja para la simplicidad de los hombres.

From the twilight of day till the twilight of evening, a leopard, in the last years of the thirteenth century, would see some wooden planks, some vertical iron bars, men and women who changed, a wall and perhaps a stone gutter filled with dry leaves. He did not know, could not know, that he longed for love and cruelty and the hot pleasure of tearing things to pieces and the wind carrying the scent of a deer, but something suffocated and rebelled within him and God spoke to him in a dream: “You live and will die in this prison so that a man I know of may see you a certain number of times and not forget you and place your figure and symbol in a poem which has its precise place in the scheme of the universe. You suffer captivity, but you will have given a word to the poem.” God, in the dream, illumined the animal’s brutishness and the animal understood these reasons and accepted his destiny, but, when he awoke, there was in him only an obscure resignation, a valorous ignorance, for the machinery of the world is much too complex for the simplicity of a beast.

Years later, Dante was dying in Ravenna, as unjustified and as lonely as any other man. In a dream, God declared to him the secret purpose of his life and work; Dante, in wonderment, knew at last who and what he was and blessed the bitterness of his life. Tradition relates that, upon waking, he felt that he had received and lost an infinite thing, something that he would not be able to recuperate or even glimpse, for the machinery of the world is much too complex for the simplicity of men.

Translated by James E. Irby (Princeton)

Is this about BIG DATA?

On rigor in science

by Jorge Luis Borges (Translation by Diego Doval)

. . . In that Empire, the Art of Cartography attained such Perfection that the map of a single Province occupied an entire City, and the map of the Empire, an entire Province. In time, these Excessive Maps did not satisfy and the Schools of Cartographers built a Map of the Empire, that was of the Size of the Empire, and which coincided point for point with it. Less Addicted to the Study of Cartography, the Following Generations understood that that dilated Map was Useless and not without Pitilessness they delivered it to the Inclemencies of the Sun and the Winters. In the Deserts of the West endure broken Ruins of the Map, inhabited by Animals and Beggars; in the whole country there is no other relic of the Disciplines of Geography.

Suárez Miranda: Viajes de varones prudentes, libro cuarto, cap. XLV, Lérida, 1658.

An Introduction to Menger’s Ontology of Economics

Start with Menger’s famous characterization of “goods”. ” Things that can be placed in a causal connection with the satisfaction of human needs we term useful things. If, however, we both recognize this causal connection, and have the power actually to direct the useful things to the satisfaction of our needs, we call them goods.” (Translation by Dingwall and Hoselitz)

Menger uses the term Güterqualität (goods-quality or goods-character) if the object (1) has properties that render it capable of causal satisfaction of a human need and (2) the putative user has command (e.g. ownership or use) of the object sufficient to bring about satisfaction. Two other mental states are requisites: (1) the subjective recognition of the human need and (2) knowledge of the causal connection between the properties of the good and need satisfaction.

Menger goes on to identify several categories of goods. Consider two: Waaren (commodities) and Gebrauchsgüter (consumer goods). They both have goods-character, but Waarencharakter differs from Gebrauchsgütercharakter. The latter is the crucial link between consumer needs/wants and the subjective valuation of the good by the buyer in exchange. The former reflects the capacity for a commodity (a higher-order good) to be transformed into a consumer good (of the first order), and whose value is subjectively held by entrepreneurs in what we refer to as the supply chain. Just as consumer goods have no intrinsic value, the primary and intermediate commodities have no intrinsic value. They are subjectively valued within the supply chain in judgments about their ökonomischer Charakter (economic-character) in transformation into consumer goods.

Menger also has in his ontology intangible goods, Verhältnissen. He describes these as including customer goodwill, contracts, copyrights, firms (even monopolies!), and trade licenses. They are the results of human action that have economic-character and can be monetized. Labor services are also goods with economic character.

There is much more to Menger’s ontology of economics, but this brief presentation allows me (with some charity from you) to say that his careful development of these universals and the relationships between them permits a highly useful introduction entrepreneurial action. Here is Dingwall and Hoselitz’ translation of a passage in Chapter 3 (The Theory of Value) of the Grundsätze.

“The aggregate present value of all the complementary quantities of goods of higher order (that is, all the raw materials, labor services, services of land, machines, tools, etc.) necessary for the production of a good of lower or first order is equal to the prospective value of the product. But it is necessary to include in the sum not only the goods of higher order technically required for its production but also the services of capital and the activity of the entrepreneur. For these are as unavoidably necessary in every economic production of goods as the technical requisites already mentioned. Hence the present value of the technical factors of production by themselves is not equal to the full prospective value of the product, but always behaves in such a way that a margin for the value of the services of capital and entrepreneurial activity remains.” (Menger trans 2007, p. 161)

Menger goes on in Chapter 3 to reinforce that the entrepreneurial action in combining “complementary goods of higher order” to create goods of lower order (including first order consumer goods) is based upon the “prospective value” of the ultimate consumer good(s) at the downstream end of the supply chain. So, subjective valuation occurs throughout Menger’s economic system and in all cases is forward- (or downstream-) looking to the valuation of the Gebrauchsgüter, which effectively governs the valuation of all the goods, including entrepreneurial action.

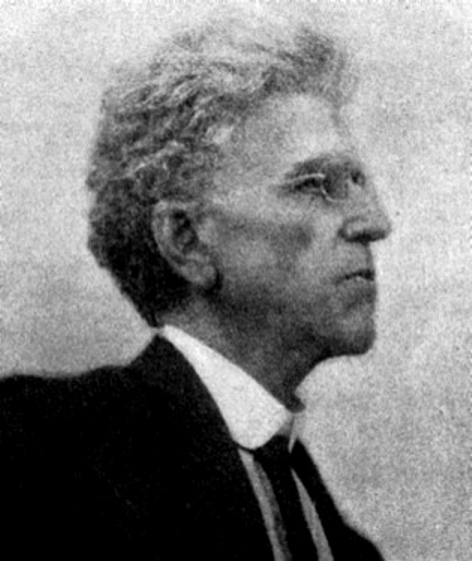

Things I like about Herbert J. Davenport

I have just finished reading Davenport’s two books: Value and Distribution (1908) and The Economics of Enterprise (1913). The former was written while an assistant professor at Chicago and is a first attempt to assess the alternative accounts of economic value (utility), capital, interest and rents, and the distribution of value among the factors of production. It is chock-a-block with passages from Classical economists and “the Moderns” (primarily Wieser and Böhm-Bawerk, but also Fisher, Fetter, Clark, and other Americans) and his comparisons among them. The latter is his textbook, written after arriving at Missouri as Chair of Economics and Dean of Commerce. It is a clear and straightforward treatment of microeconomics theory, centered upon the problems of valuation and distribution. It is the clearest interpretation of the Austrian approach to economics (in English) that existed for half a century or more.

I have just finished reading Davenport’s two books: Value and Distribution (1908) and The Economics of Enterprise (1913). The former was written while an assistant professor at Chicago and is a first attempt to assess the alternative accounts of economic value (utility), capital, interest and rents, and the distribution of value among the factors of production. It is chock-a-block with passages from Classical economists and “the Moderns” (primarily Wieser and Böhm-Bawerk, but also Fisher, Fetter, Clark, and other Americans) and his comparisons among them. The latter is his textbook, written after arriving at Missouri as Chair of Economics and Dean of Commerce. It is a clear and straightforward treatment of microeconomics theory, centered upon the problems of valuation and distribution. It is the clearest interpretation of the Austrian approach to economics (in English) that existed for half a century or more.

- Davenport came to economics as a pragmatist with a scholar’s thirst. He was trained as lawyer (Harvard) and made and lost a fortune in land speculation in the Dakotas. He subsequently studied at the University of Leipzig and l’École Libre des Sciences Politiques (commonly: Sciences Po) in Paris. He entered the University of Chicago to take the doctorate in economics at the age of 36 and finished a year later in 1898, after studying with Thorstein Veblen and J. Laurence Laughlin. He read the new thinking of Eugen von Böhm-Bawerk and Friedrich von Wieser in German and some of the French scholars (Say, Turgot, and Cantillon) in French. He absorbed the Anglophone literature, as well. He chose carefully among these accounts in creating his own account, which developed from his first book, Outlines of Economic Theory (1898) through Value and Distribution and The Economics of Enterprise.

- Davenport eschewed mixing economic theory with social and political economics. Thus, he did not participate in the institutionalist movement in the US. While he had enormous respect for Veblen’s views on social issues, they were not incorporated into any of his books or journal papers on the science of economics. The exclusion of social policy caused some ill feelings and some testy reviews by confrères in the profession, especially of the 1913 book. In that book, he considered all forms of value creation, including snake-oil salesmen, prostitutes, makers of burglar’s tools, and other pariahs, specifically because they created goods and services that were valued by buyers. Therefore, these were indeed economic activities and the value they created could be imputed to the services of labor and capital that were used in production. Furthermore, there was no room for the Progressive movement in American society with the study of economic theory. This stance is consistent with the approach of Frank Knight, as evidenced by his writings of the 1920s and 1930s. Knight believed that social values were a social issue, not an issue of economic theory. davenport’s theorizing is also consistent with the approach of Carl Menger in the Grundsätze der Volkswirtschaftslehre (Principles of Economics, 1871), though I cannot find evidence that Davenport read Menger. It appears that his access to Menger came from the writings of Menger’s students, Wieser and Böhm-Bawerk.

- Davenport shared Menger’s approach that there are important intangible economic goods, as well as economic goods that are viewed with disdain by social standards. All of these share the only common element that matters to economic theory: they create value for buyers/users. And that value is determined by a subjective valuation by each individual buyer in an individualized transaction with the seller. There is no market price that represents meaningful social valuation. Any transaction price represents an acceptance by the parties that their marginal utilities in that specific circumstance are met by the exchange. As such, Menger and Davenport have a methodological individualistic account of economic theory. Moreover, both accounts follow the two components of methodological individualism: ontological individualism (the theory rests entirely upon individual mental states and action) and explanatory individualism (the causal processes that explain economic exchange are best understood at the individual level). Note that these two accounts are not the way we typically teach economics, with market supply and demand curves denoting a market price and quantity exchanged. (Note that use “denote” rather than “cause” or “explain”. I will elaborate on this in a future post.)

- Not only does Davenport’s account of economic value determination in the market avoid social valuation and admit all economic goods, he also slams Classical accounts and many Neoclassical accounts for separating factors of production into Land, Labor, and Capital. Davenport first notes that any Biblical or populist basis for keeping Land separate from Capital is a nonsense (take that, Henry George!). Both provide services to the entrepreneur and their economic value is imputed from the value determination by the buyer of goods produced using those services. That leads easily to the result that Labor services are valued in the same way. The other point that Davenport makes, which is at odds with Neoclassical theory of this era, is that one cannot speak about the marginal value of units of Capital or Land or Labor as separable, social measures of value. In any given enterprise, it is only with the complementarity of the streams of services from all factors that value is created and imputed. So the addition or deletion of a single Labor hour or acre of Land at the margin cannot be valued outside the context of the specific enterprise. A farm laborer who works on two adjacent farms will not have the same marginal value product or implicit wage. Adding up the quantity of any factor of production at a sectoral level cannot lead to any meaningful social valuation of the marginal value product of that factor.

- I have insisted that Davenport kept economic theory separate from elements of social welfare and political economy. But how does that fit with his evident admiration for Thorstein Veblen? Like Knight, Davenport was not silent on social issues; he kept them isolated from his theoretical account. Unlike many economists of this period, including two Americans with whom Davenport is linked (not by him!) as the American psychological School, Irving Fisher and Frank Fetter, Davenport was firmly against the eugenics of the Progressive movement. He also wrote two papers that were never published in their entirety, though the ideas were presented in his 1898 book and further developed as speeches at Cornell University in 1917. One decried conspicuous consumption and the other supported a feminist economic position. In the former, he sounds like Veblen! In the latter, he calls for valuation of women’s household work and against “progressive” legislation that excluded women from the labor force, so as to protect men’s wages. I point you to a remarkable analysis of these two papers in the context of other economists’ public positions by Luca Fiorito and Tiziana Foresti (“Herbert J. Davenport on Conspicuous Consumption and the Economics of Feminism”, Journal of Economic Issues, vol. LIII, no.1, March 2019, pp. 277-287.) This is reason enough to like and admire Herbert J. Davenport.

Schumpeter and Entrepreneurship in the Large, Established Firm

Last week, Nicolai Foss posted a short blog piece on entrepreneurship in the established firm. In the subsequent exchanges of commentary, it was noted that Schumpeter wrote of this beginning in the late 1920s (in German) and in two of his most most cited (and sometimes read) books, The Theory of Economic Development and Capitalism, Socialism, and Democracy – written in English after his move to Harvard University. Unlike his early writings, wherein the entrepreneurship cycle was about new firms supplanting old firms, these books allowed for innovation to happen as a strategic choice within large oligopolistic firms. Naturally, this type of innovation does not supplant the existing firm – a strategic suicide, but permits a number of production functions to coexist in the large, established firm. And any of these may be jettisoned over time in response to their failure to sustain profits.

These insights from Schumpeter are scattered in these two books and his other writings. And if a reader hasn’t gotten past the paragraphs on creative destruction, these insights remain unseen.

Fortunately, one scholar has invested the time and intellect necessary to bring these scattered insights together and formalized a model that contrasts with the small-firm entry/exit model of Schumpeterian competition. Esben Sloth Andersen is a professor of evolutionary economics and industrial dynamics at Aalborg University. His scholarly portfolio brings together his work on simulation models of innovation and industry evolution, his examination of theories and models from evolutionary biology, and a series of erudite publications on Schumpeter and his work. Andersen has written three books that are must-reads for persons working in evolutionary economics, entrepreneurship, and strategy and competition. The first is a mid-1990s volume titled Evolutionary Economics: Post-Schumpeterian Contributions (Pinter), in which he uses simulation methods to elucidate Nelson and Winter’s 1989 classic book, while relating it to other models of firm and market dynamics. The two recent books – Schumpeter’s Evolutionary Economics (Anthem, 2009) and Joseph A. Schumpeter: A Theory of Social and Economic Evolution (Palgrave Macmillan, 2011) – are truly marked by erudition. That is, they are comprehensive, clear, and have a “spine” constructed by the author that makes the subject matter coherent.

At the risk of offending Professor Andersen by offering caricatures of his works, I would say that the 2009 book is more comprehensive. It is very complete in covering Schumpeter’s work on economic dynamics, with specific contrast to prevailing static economic theory, from the first German texts of 1908 and 1912 through the complex tome of Business Cycles (1939), and to the posthumous History of Economic Analysis. In this book, Andersen introduces his conceptions of three Schumpeterian evolutionary models, which he calls Mark I, Mark II, and Mark III. The first contains the small-firm entry/exit model and contains the elements of the cyclical innovation model. The second introduces the “trustified” economy and permits large, oligopolistic firms to evolve without self-destruction within the innovation cycle. The third considers the social dynamics which were evident in the early Schumpeter’s interest in evolutionary social science: the interlocking social, political, and economic systems which he wrote about in Capitalism, Socialism, and Democracy. Andersen makes it clear that there is not one Schumpeterian evolutionary model, although he gently notes that in a casual reading of any or all of Schumpeter’s books, one will not find this obvious.

The most recent book, which is part of the Palgrave series on Great Thinkers in Economics, contains all of the main arguments of Andersen’s 2009 book and presents them in an exceptionally clear exposition. Some of the historical details and some elaborations are left out to more effectively highlight the Mark I, II, and III models. I have purchased a dozen copies of this book to share out with graduate students and colleagues and find it to be a superb way to enter the literature by Schumpeter and about Schumpeter. There is some interesting biographical material, as well. I would argue that this is a place to begin, then one gets even more from reading McCraw’s Prophet of Innovation and Andersen’s Schumpeter’s Evolutionary Economics.

Finally, for skimmers, I point to chapter 9 in Schumpeter’s Evolutionary Economics and chapters 10 and 14 in the Palgrave book as the places to see the model of innovation in the large, established firm. Then, we can respond to Professor Foss’ call to arms.

Some thoughts on microfoundations of entrepreneurship: emergence, aggregation, and supervenience

I have posted recently on the microfoundations of entrepreneurship, particularly of collective entrepreneurship. This latter term is used to denote the superset of team entrepreneurship or group entrepreneurship – whether as a startup or within and existing organization – and entrepreneurial ventures that are a strategic alliance of (usually small) firms, as in the wine trails and food hubs I am studying with my colleagues. For me, the context of the collective as a stand-alone new venture or a team venture in a large corporation is less important than the phenomenon of this particular form of collective action. That is, how do these groups form and act jointly in new venture creation?

In one post, I looked to the discipline of philosophy. I highlighted the work on social ontology as one lens to study group intention (to act) and group agency – the ability for a collective to act. This is truly a microfoundational approach to the study of the inception of collective ventures. I intend to see in the next two years whether the theories of group agency from the social ontology literature can be linked empirically to the model of relational demography proposed by Martin Ruef. Ruef is concerned with the “glue” that holds entrepreneurial teams together. There is no obvious reason to believe that mechanisms that permit group formation and initial agency will remain as the group/firm evolves over time. In fact, one of the most interesting subjects to research might be the process of defections from startup teams and firms as the venture matures. To what extent are defections a result of the changing context of the venture, thus violating the initial conditions for group intention? To what extent are defections caused by significant changes in the group ethos from the startup to the established enterprise? And, is the changed ethos necessary to maintain the group agency inherent in the established firm – Ruef’s glue?

This brings me to a post today on the Organizations and Markets website. Nicolai Foss points to an essay in Strategic Organization he co-authored with Jacob Lyngsie on entrepreneurial activity in the established firm. The paper takes on the construct of the entrepreneurial opportunity as a useful explanans for entrepreneurial activity. See my wholehearted agreement with this issue here. But the paper caused me to think more about the relationship between two issues near and dear to Professor Foss’ heart: entrepreneurship as a function distinct from firm founding and the microfoundations of organizational theory and strategic management. See, for example, these posts on microfoundations at Organizations and Markets (here, here, and here).

There is a troubling term in the microfoundations project: emergence. If the microfoundational models of actions within and at the interface with the market are necessarily grounded in individual action, as the micro-fundamentalists aver, then there must be something that links individual intention and individual action to group intention and to group action. One often sees this described as emergence of the higher-level phenomenon from the lower-level phenomenon. I will leave aside the social fact that emergence is the sine qua non of the claptrap known as critical realism. Even social scientists that are wary of critical realism will invoke emergence, or aggregation (see Barney and Felin, 2013). Aggregation would seem easier than emergence, as “adding up” is an easier thing to do than describing an emergence process. But, anyone who has taken a graduate course in price theory has seen the aggregation problem with something as (seemingly) simple as aggregating individual demand functions into a market demand function.

Emergence as a research phenomenon provokes me to ask two questions. What explains emergence? That is, emergence is an explanandum, a phenomenon that must be explicable. If one cannot explain how group action emerges from individual action (save for “adding up”), then it is mysterious – the same argument that reductionists have made against holistic explanation for centuries. And, of course, this is the reason that the micro-fundamentalists express a reference for micro-level explanations. The second question follows. What does emergence explain? Obviously, we are meant to see that emergence explains the micro-macro linkages. But to do so requires that emergence must be understood as a phenomenon in sufficient detail to show how it explains macro phenomena. It is not enough to declare that it explains; one must confirm the explanation with empirical research. See a paper that André Ariew and I wrote for the Strategic Management Society Special Conference on Microfoundations held in Copenhagen 13-15 June 2014. The paper describes in detail the issues of explanatory reduction in following a microfoundations project.

Ariew and Westgren Microfoundations and Reductionism

The other word we can consider at this point is supervenience. This term is closely aligned with emergence, but has a more concrete definition. One may say that a set of facts supervenes on another set of facts. This works with social facts as well as physical facts. That is, a supervenience relation may exist between the attitudes and actions of a group and the attitudes and actions of its individual members. This, I believe, is the essence of the microfoundations project: discovering how group actions supervene upon group members.

I point you to one of the books I noted in my introduction to social ontology: Group Agency by Christian List and Philip Pettit. In this book, List and Pettit discuss supervenience with particular regard to the group agent (i.e. the firm-as-agent) and the members of the firm. This is a very careful analysis of the propositions that must hold for us to say that the actions of the group agent truly supervene on the attitudes and actions of the members of the group. In their analysis, they show that no voting rules are sufficient to support supervenience, but they claim that robust group rationality (a set of necessary conditions) will support what they call holistic supervenience – not tied to particular propositions or sets of propositions that we might call decisions of group ventures. Then they spend the bulk of the book describing the desiderata of organizational structures that permit individual attitudes to be aggregated, including incentive alignment and control. Management scholars will recognize these phenomena are part and parcel of organization theory. List and Pettit just bring these to light within the context of organizational design to permit group agency.

Just like what Foss and Lyngsie wish to see in corporate entrepreneurship research.

A Structural Hole in Salt Lake City

My writing coach says that I should write first thing in the morning, but writing took second place this morning to the arrival of three new bookcases in my office. Forty-five linear feet of new storage and display! So all the books were sorted and re-shelved. I separated the strategy from organization theory, Schumpeter from everyone else, and the philosophy of science from science. And the critical realism and evolutionary economics books are now on a bottom shelf in the corner – out of sight.

Anyhow, back to the subject at hand, even though it is nearly midnight.

A Structural Hole in Salt Lake City

Dear reader, if you are unfamiliar with the term structural hole, as it is used in social network research, I shall elucidate briefly. One of the least intuitively named constructs in the social sciences, the structural hole is a knowledge bridge between two different networks. The “hole” represents a sparse nexus of connections in the overall network. In a visualization, this would look like a gap in what would otherwise be a dense web of redundant connections.

Now to describe it as a bridge, rather than a hole…

One of the exciting scholarly partnerships that will drive new thinking in entrepreneurship research is between Robert Wuebker and Russell McBride of the Eccles School of Management at the University of Utah. Rob has a background in startups and innovation. Russ is a philosopher of mind. They work together, across the network boundary between strategy and cognitive science, on developing a new theoretical account of entrepreneurial action. It is based upon social ontology, in which Russ was trained under John Searle of the UC-Berkeley Department of Philosophy.

At the Academy of Management meetings in Philadelphia this week, Rob organized a session on the social ontology of entrepreneurship. Russ led off the session with an introduction to social ontology, stressing the importance of the language – speech acts – in building shared understanding of concepts that take on the ontological status of social facts. The classic examples used are paper money as currency and socially constructed titles like “President of the United States”. This presentation was followed by a very interesting “next step” paper co-authored by McBride, Wuebker, and a researcher from ESADE in Spain, Jana Thiel. In this paper, (see here) they do two important things. First, they explicitly unyoke entrepreneurial action from entrepreneurial opportunities, particularly those that are allegedly discovered as objective facts. Second, they propose a three-phase process of the creation of a new social institution – the entrepreneurial venture – that begins with a declarative (speech act). This phase is followed by enrollment, the social interactions that occur around the declarative between persons that will associate with the venture (team members, funders, customers). The third phase is embedding, completing the construction of the new social reality by linking the venture to the broader social environment, i.e. the market. Along the way, the authors note the linkage to the microfoundations project that is afforded by a theory of entrepreneurial action that cannot be mimicked by “the opportunity”.

I want to make one observation about the ambitious project that Wuebker and McBride and their collaborators have begun. There are two important levels in which social ontology will inform entrepreneurship research. First, the process of social ontology occurs at the level of the community of scholars engaged in creating social facts that can be researched and taught. The community can agree on the constructs, models, and processes associated with innovation and other forms of entrepreneurial action. Second, social ontology offers an account of entrepreneurial action that that deals with what I call collective entrepreneurship, others call team entrepreneurship, and what Wuebker calls joint action. Rather than having some mysterious, emergent process or just-so stories serving as the accounts of entrepreneurial action, accounts that are based on social ontology can be defensible as good science.

Collective Entrepreneurship – Social Ontology as a Microfoundation

I have withheld posts to this blog for more than a week, as I prepared a written piece to support some comments I will make to a professional development workshop at the annual conference of the Academy of Management. I look forward to this conference for two reasons. First, I really enjoy Philadelphia — a city I came to love as a youngster who spent summers here with cousins, up through my second year at university. Secondly, the conference always has some provocative paper sessions and vigorous discussions in the hallways and surrounding barrooms. This year, the scholars who engage in entrepreneurship have put together some top-flight sessions.

I have been reading the literature of social ontology. It deals with the structures that permit and support group intentions and agency. That is, it is not enough to say that “I intend to pursue outcome J” and “you intend to pursue outcome J”, therefore we collectively intend to reach J. This is especially true in nominally large groups, where each member may accept the value of outcome J and tacitly support those members of the group who actively intend to pursue J, but to say that the whole group collectively intends that the group pursue J is patently false.

The philosophers who write on the subject make the distinctions clear between intentions held by individuals and intentions that are held by the group in some way that is not reducible to the simple summation of each member’s intentions. Moreover, they construe intention to include a commitment to action with a specific content, not just exist as an attitude or state of mind. Note the differences among the following.

1. I intend to start a new venture that uses intellectual property I control.

2.I intend to start a new venture that uses intellectual property I control and I will hire expertise in marketing to enable this.

3. I intend to start a new venture that uses intellectual property I control. Amelia intends to start a new venture that uses her particular skills in marketing.

4. Amelia and I intend to start a new venture that uses my intellectual property and her marketing skills.

5. Amelia and I intend to start a new venture to produce a dog food product that reduces Fido flatulence. I contribute my intellectual property and Amelia contributes her marketing expertise to this jointly owned venture, which will lead to shared outcomes for both of us.

It is the last instantiation of intended joint action that satisfies the strict requirements of shared intention for social ontologists, as it has specific content (‘we intend to jointly do J”) and has implications of commitment by both parties, shared understanding and beliefs, and a jointly obtainable outcome that is unobtainable by either party. As a caricature, this has elements of “I know that you know” and “you know that I know” and “I know that you know that I know”, etc. But a careful reading of the literature shows the necessity for making distinctions between individual intentions (even though they may parallel those of other individuals) and those intentions that are truly joint. The ontologists posit a number of accounts for how the jointness is established, ranging from shared ethos to pre-existing interpersonal commitment to shared formal plans to established authority relationships.

I have attached the essay I wrote for the session on social ontology and entrepreneurship. It has three parts. The first part looks exactly like the previous blog post on collective entrepreneurship. The second part addresses two projects that I am involved with that empirically test the Ruef model of relational demography for collectives of small firms. This blog will report on the empirical work in the coming months. The third section introduces social ontology and describes some of the recent books produced on the subject and how they are related to our interests in the individual-collective boundary in entrepreneurship. A reading list follows this section.

An Essay on the Social Ontology of Collective Entrepreneurship

Collective Entrepreneurship – Introduction

This post has two purposes. First, it begins a series of written posts to describe a research program that I and several colleagues have embarked upon in the past 18 months. Collective entrepreneurship, as I define it, includes both entrepreneurial teams — a typical unit of analysis in the field — and joint entrepreneurial ventures whose members are firms. Subsequent posts will describe particular studies of entrepreneurial collectives. This post is conceptual. The second purpose is to test a writing method that permits me to move between writing projects with limited friction. This method is described in an earlier post.

I must highlight two sources of inspiration for the post below. The first is a comprehensive review of literature by Molly Burress and Michael L. Cook, which is in the reference list. Cook holds the Robert D. Partridge Chair in Cooperative Leadership at the University of Missouri. He is recognized internationally for his research and education programs on cooperatives. Burress served as a program director for Cook at the time the literature review was completed. Suffice it to say that their joint effort in completing the review is gratefully acknowledged. The second inspiration is Martin Ruef’s 2010 book, The Entrepreneurial Group (Princeton University Press). His model of the what binds members of entrepreneurial teams to each other is a powerful tool for analysis.

The term collective entrepreneurship appears only recently in the literatures of economics, management, and entrepreneurship. In a review of the literature, Burress and Cook (2009) note 240 publications that invoke this term since 1964, with more than half the references occurring since 2000. They develop a taxonomy of the motivations for the juxtaposition of collective with entrepreneurship ranging from theoretical development through public policy and political action. Burress and Cook define the scope of the collective as a significant axis in the taxonomy. The scope of the collective action ranges from “intra-organizational efficiency” to “inter-organizational goals” to “economic growth and development” through “socio-political change”. That is, the narrowest scope is the entrepreneurial team or venture and the largest is the social movement. Entrepreneurial joint ventures and public-private partnerships are exemplars of scope interior to the axis.

In the work we are doing in the McQuinn Center for Entrepreneurial Leadership, we take a similar view of the primacy of organizational scope, though we are less interested in those collective actions where the benefits are not appropriable by the members of the collective. In all entrepreneurial ventures, social and public benefits may exist but as a phenomenon to be studied, they are more à propos to social movements research. We recognize, on the other hand, that social movements provide opportunities for entrepreneurs to act, perhaps as a collective, and to appropriate entrepreneurial rents (Weber, Heinze, & DeSoucey, 2008).

Let us consider three forms of collective entrepreneurship and the explicit boundaries they engender. The first is the entrepreneurial team that collectively founds and manages an organization. Reich (1987) correctly notes that the preponderance of entrepreneurial ventures are not founded by the iconic “lone inventor”; most new ventures represent the combined efforts of a number of individuals – though their particular levels of investment may vary. This view is elaborated by Ruef (2010), who begins his treatise on group entrepreneurship with Toqueville’s vision of an associative culture in America and describes the phenomenon of collective action among “co-founders, employees, investors, advisors, or unpaid helpers” (p. 13) to create new firms. Ruef develops a model of the relational demography of group adhesion to the shared venture that is built upon four key elements: structure (roles and contracts), strong ties (networks and trust), homophily (shared characteristics), and identity (shared subjective beliefs and goals). We find this model to be a useful point of departure for collective ventures, within and between firms.

The second common instantiation of collective entrepreneurship is the cooperative form of organization. Most of the examples of this type of organization arise in the agricultural sector, where cooperatives have more than a century of importance to the American and European economies. Agricultural cooperatives have been institutionalized as a form of collective action to counteract market power in the markets into which farmers sell and from which they purchase inputs (Knapp 1969, 1977; Nourse 1942). The traditional cooperative had farms as members of the collective enterprise, with one membership/voting share for each farm. Note that this is a different form of collective than the entrepreneurial team, as the members are themselves individual firms.

Some recent research into cooperatives as entrepreneurial collectives raise the question of whether such organizations can act “entrepreneurially” in the face of changing market conditions (Bijman and Doorneweert 2008, Cook & Plunkett 2006, van Dijk 1999, Nilsson 1999). One interesting conceptual issue raised in these papers is whether entrepreneurial activity (innovation, new products, new markets, etc.) occurs at the level of the collective as an organizational strategy or at the level of the individual member-farmer. This is a particular instance of the broader question of whether actions can be taken by groups or only by members of the group – the central tenet of methodological individualism.

Both the entrepreneurial team literature and the entrepreneurial cooperative literatures require the establishment of a firm as the “envelope” around the collective action. The entrepreneurial firm discussed by Ruef has a social identity, as well as legal status. The same holds for the agricultural cooperative, which under various statutes in the United States, is organized as a corporation. The “membrane” around the collective action is an organizational form.

The third form of collective entrepreneurship in the literature considers collective action without this membrane, and overlaps with Burress and Cook’s category of “economic growth and development”. We might call this networked entrepreneurship. Networked entrepreneurship, as we see it, follows closely the model proposed by Johannisson and colleagues in describing a geographically delimited, networked community of entrepreneurs that jointly enact their business environment in common (Johannisson and Dalhstrand 2008; Johannisson, Ramirez-Pasillas and Karlsson 2002). These networks include research parks and industrial clusters. The members of this collective form are typically firms or strategic business units rather than individuals.